Streamlining the FQHC Billing Process

Implement Sliding Fee Scales

FQHCs often receive enhanced rates for Medicare and Medicaid patients, but they are also obligated to offer sliding fee scales to uninsured individuals. Financial assessments are performed to determine a patient’s eligibility for discounted rates. To simplify this process, applying a uniform, all-inclusive fee based on eligibility is often effective. Periodically reviewing the costs of services ensures that they can be offered at a reduced rate without sacrificing revenue.

Verify Patient Eligibility Prior to Service

Before providing any medical services, it’s essential to confirm a patient’s insurance status or eligibility for other payment sources such as Medicare, Medicaid, or third-party payers like MCOs, HMOs, and PPOs. Obtaining this information upfront can prevent unpaid claims and expedite the billing process.

Maintain Accurate and Detailed Records

Efficient record-keeping is vital for FQHCs. This includes documentation from the point of scheduling to service delivery and home visits. Accurate records are key for correct billing and can quickly resolve any questions or disputes regarding treatment or charges.

Understand Your Contracts with Payers

Commercial insurance companies frequently collaborate with FQHCs. Therefore, understanding payer contracts, along with their specific coding and billing procedures, is crucial. These contracts often stipulate whether the FQHC can implement sliding fee reductions for eligible members and under what conditions.

Navigate Bundles and Claim Forms Skillfully

FQHC billing involves specialized knowledge of codes and claim forms. The Health Resources and Services Administration provides guidelines to assist billing teams in understanding what services can be bundled together. Mastery of these complexities can make you a valuable asset to any healthcare organization, not just FQHCs.

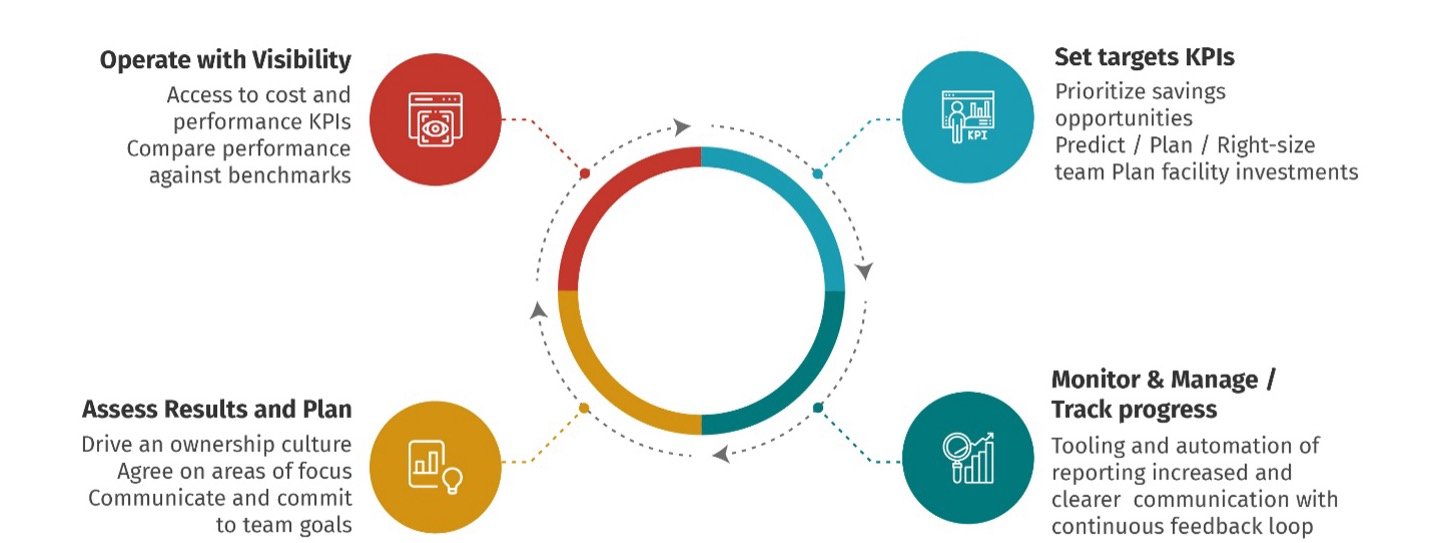

Establish an Integrated Reporting System

To optimize revenue management and billing efficiency, implement a robust reporting system that tracks revenue collection, key performance indicators (KPIs), and overall departmental efficiency. This data-driven approach aids in decision-making and future revenue maximization.

FQHC Financial Management

The Board of Directors of a Federally Qualified Health Center (FQHC) holds significant responsibilities in the area of financial management and oversight to ensure the sustainability and effectiveness of the organization. They are legally and ethically obligated to maintain fiduciary responsibility, ensuring that the organization’s finances are managed in a manner that aligns with its mission to provide affordable, high-quality healthcare services to underserved populations. Key financial oversight duties include reviewing and approving annual budgets, ensuring that financial reports are accurate and transparent, overseeing external audits, and ensuring compliance with federal, state, and local financial regulations. The Board also plays an integral role in setting long-term financial goals and strategies, including capital projects and expansion plans. Financial mismanagement or the absence of effective oversight can not only jeopardize the organization’s financial health but can also risk the loss of federal funding and public trust, making this aspect of governance critically important. Financial management oversight may be achieved through the following provisions:

1. Regular Financial Reporting and Review

-

Monthly Financial Statements: The board should review monthly financial statements, including balance sheets, income statements, and cash flow statements, to track the organization’s financial health.

-

Budget vs. Actual Reports: Comparing budgeted numbers against actual financial performance helps in identifying variances and taking corrective action.

2. Audit Oversight

-

Annual Audits: External audits provide an unbiased review of financial statements. Board members should not only review the findings but also ensure that corrective measures are implemented.

-

Internal Audits: Regular internal audits can offer insights into the effectiveness of financial controls and compliance with grant requirements and other financial obligations.

3. Monitoring Revenue Streams

-

Federal Grants and Reimbursements: Given the reliance on federal funding, the board should closely monitor the grants, reimbursements, and any other funding the center receives.

-

Self-Generated Revenue: Oversee the center’s revenue-generating activities, ensuring they align with the FQHC’s mission and don’t compromise its non-profit status.

4. Expense Control

-

Operating Expenses: Regularly review operating expenses and inquire about any significant overages or unusual expenditures.

-

Capital Expenditures: Review and approve significant capital expenditures, making sure they align with both short-term needs and long-term strategic goals.

5. Risk Management

-

Insurance Coverage: Ensure that the FQHC maintains adequate levels of malpractice, property, and other necessary insurance.

-

Legal Compliance: Regularly consult with legal advisors to ensure compliance with federal, state, and local laws related to financial operations and reporting.

6. Cash Flow Management

-

Reserves: Monitor cash reserves to ensure there’s sufficient liquidity for both planned activities and unforeseen contingencies.

-

Debt Levels: Keep an eye on the organization’s debt and its ability to meet obligations.

7. Stakeholder Communications

-

Transparency: Financial updates should be communicated transparently to stakeholders, including staff and the communities served.

-

Donor Relations: Keep track of donor funds and grants to ensure they are being utilized as intended and reported back to donors appropriately.

8. Performance Metrics and KPIs

-

Financial Ratios: Utilize key performance indicators like operating margin, days cash on hand, and debt service coverage ratios to assess financial performance.

-

Benchmarking: Compare the FQHC’s financial metrics against industry benchmarks to gauge relative performance.

9. Technology and Data Analytics

-

Integrated Financial Systems: Utilize integrated financial software for real-time monitoring and reporting.

-

Data Analytics: Use advanced data analytics to draw insights from financial and operational data, supporting strategic decisions.

Image Credit: EasyMetrics

Article By: Jonathon North, Burrows Consulting